The most (and least) expensive states for retirees

Retirement is the well-earned chapter of life when you can finally escape the busy workweek to focus on relaxation, personal pursuits and quality time with your loved ones. But before you start daydreaming about mild weather and sandy beaches, there’s an important question to consider: Where will you get the most out of your nest egg?

While every state has its unique charms, from ocean views to stunning mountains, a beautiful backdrop won’t guarantee a stress-free retirement. Retiring comfortably is just as much about finding a nice place to spend the rest of your life as it is about your financial situation.

In this report from Ooma, we’re looking at the most and least expensive states to retire in as well as the reasons behind the stark differences across the country.

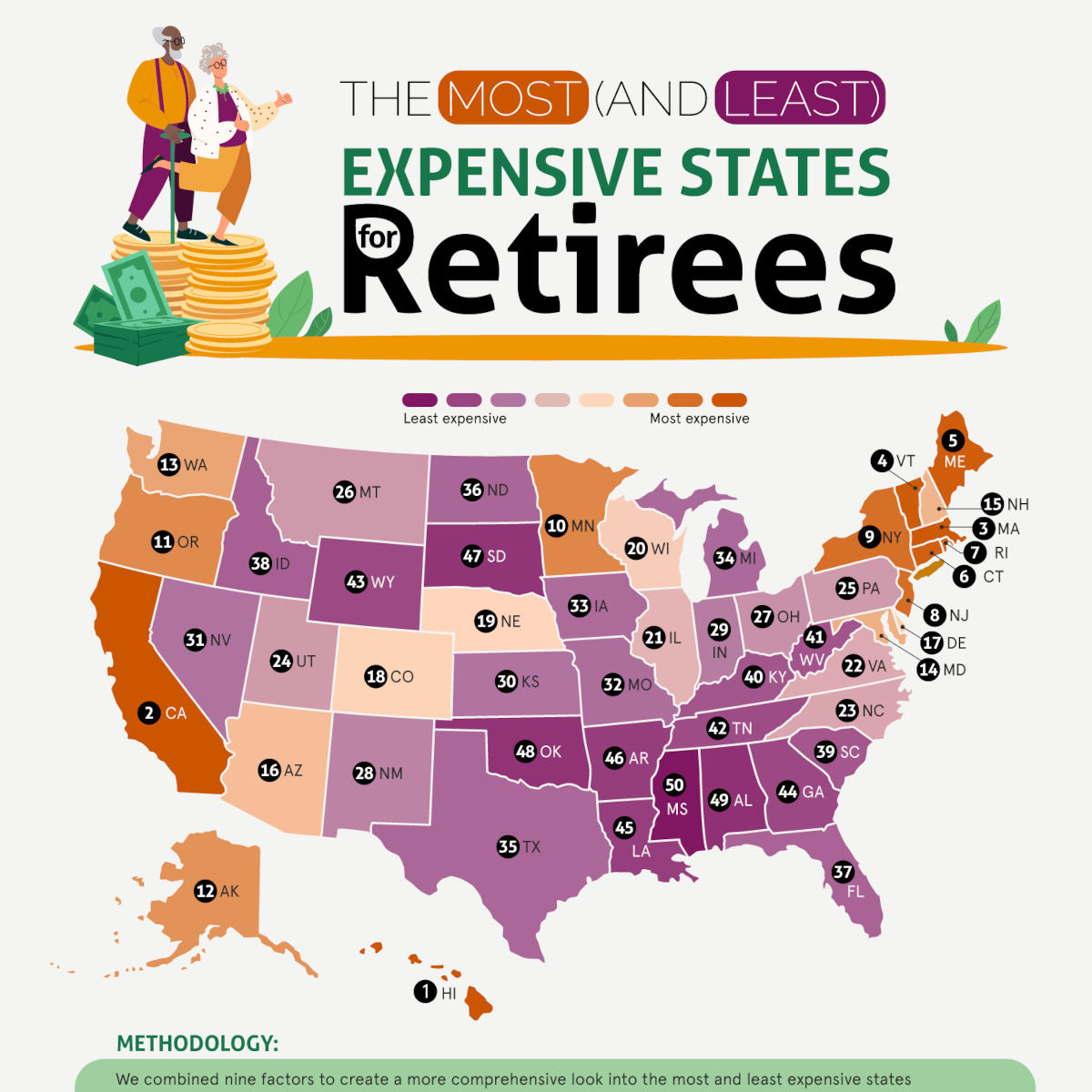

Examining retirement costs across the states

When it comes to retirement costs, each state brings its own set of challenges and opportunities. For example, a comfortable lifestyle in Hawaii would likely require a minimum savings of $2.2 million for retirement, driven by high living costs and the premium placed on the idyllic lifestyle the islands offer. In contrast, states like West Virginia have far more modest minimum savings thresholds, at just more than $700,000. However, high-cost-of-living states may still be economical, such as in Florida, where the state does not impose income tax on retirees. In contrast, California, a state with a relatively high cost of living, imposes a proportionally high tax burden.

Assisted living and memory care costs represent another substantial aspect of retirement planning. In Hawaii, one of the most expensive states to retire in, assisted living averages a whopping $140,000 per year, whereas in Mississippi, it can be less than $55,000. Hourly home care costs can vary significantly and are likely to be an important factor for anyone who hopes to avoid an assisted living facility. Mississippi remains the most budget-friendly option at just $24 per hour, while Minnesota reaches $43 per hour, reflecting substantial differences in care-related expenses.

Why are the most expensive places to retire so popular?

With such high price tags, it can sometimes seem confusing that the over-65 crowd still flocks to places like Florida, California and Hawaii. As it turns out, retirement isn’t just about the numbers.

For many, warm weather and a laid-back lifestyle are invaluable. Hawaii’s endless summer, California’s mild weather and Florida’s palm-lined beaches can make daily life feel like a vacation. A lack of harsh winters, heavy snowfall and icy roads might be enough to balance out even high humidity, hot summers and a high cost of living for some.

Quality healthcare also sweetens the deal. States like Massachusetts, Connecticut and New York boast some of the best medical care in the country, which can be an incentive even with the high cost of such services. For those with health concerns, knowing you’re close to top-notch hospitals and specialists can be priceless, bringing peace of mind.

Apart from weather, healthcare and cost, some might also want to live close to amenities and entertainment. From California’s media landscape and endless festivals to New York’s bustling music and theater scene, these states promise retirees a vibrant lifestyle with something fun around every corner.

It’s also important to note that these states are often as expensive as they are due to their popularity. High demand drives up the cost of real estate and other living expenses.

Best and worst states to retire

So where should you land if you’re after the perfect retirement? While it’s largely a personal choice, there are some states that stand out.

Three states rise to the top as the most economically retirement-friendly: Mississippi, Florida and Wyoming. Mississippi’s low cost of living, affordable healthcare and budget-friendly housing make it an ideal choice for retirees looking to stretch their dollars. Florida combines financial savings with sunny weather and an active lifestyle, while Wyoming’s tax benefits and healthcare affordability add to its appeal.

On the other side of the spectrum, the data reveals California, Hawaii and New York as some of the least affordable states for retirees. California’s high taxes, expensive assisted living and healthcare costs push it out of reach for many. Hawaii’s breathtaking scenery comes at a steep cost in retirement savings, and New York’s sky-high healthcare expenditures and taxes demand serious financial planning. These states may offer incredible amenities, but they’re not always easy on the wallet.

Retirement can be the adventure of a lifetime, and choosing the right place to settle can be one of the most impactful decisions of your golden years. Whether you’re pinching pennies or treating yourself to beachfront bliss, knowing what’s out there can help you plan wisely.

At Ooma, we’re committed to providing you with the tools to stay connected no matter where you end up, from reliable internet access to affordable home phone services. Reach out today to learn how our communications solutions can keep you linked to the people and activities that matter most.

States with the highest and lowest retirement costs

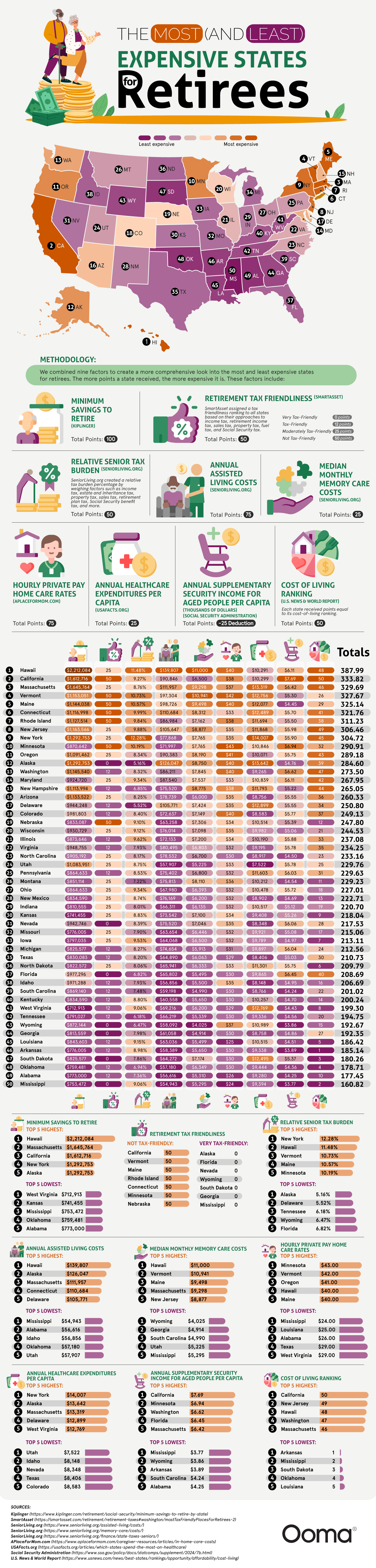

We combined nine factors to create a more comprehensive look into the most and least expensive states for retirees. The more points a state received, the more expensive it is.

Minimum savings to retire (Kiplinger)

Total points: 100

Top 5 highest:

- Hawaii $2,212,084

- Massachusetts $1,645,764

- California $1,612,716

- New York $1,292,753

- Alaska $1,292,753

Top 5 lowest:

- West Virginia $712,913

- Kansas $741,455

- Mississippi $753,472

- Oklahoma $759,481

- Alabama $773,000

Retirement tax friendliness (SmartAsset)

SmartAsset assigned a tax friendliness ranking to all states based on their approaches to income tax, retirement income tax, sales tax, property tax, fuel tax and Social Security tax.

Total points: 50

Very tax-friendly: 0 points

Tax-friendly: 12 points

Moderately tax-friendly: 25 points

Not tax-friendly: 50 points

Not tax-friendly:

California 50

Vermont 50

Maine 50

Rhode Island 50

Connecticut 50

Minnesota 50

Nebraska 50

Very tax-friendly:

Alaska 0

Florida 0

Nevada 0

Wyoming 0

South Dakota 0

Georgia 0

Mississippi 0

Relative senior tax burden (SeniorLiving.org)

SeniorLiving.org created a relative tax burden percentage by weighing factors such as income tax, estate and inheritance tax, property tax, sales tax, retirement plan tax and Social Security benefit tax.

Total points: 50

Top 5 highest:

- New York 28%

- Hawaii 48%

- Vermont 73%

- Maine 57%

- Minnesota 19%

Top 5 lowest:

- Alaska 16%

- Delaware 52%

- Tennessee 18%

- Wyoming 47%

- Florida 82%

Annual assisted living costs (SeniorLiving.org)

Total points: 75

Top 5 highest:

- Hawaii $139,807

- Alaska $126,047

- Massachusetts $111,957

- Connecticut $110,684

- Delaware $105,771

Top 5 lowest:

- Mississippi $54,943

- Alabama $56,616

- Idaho $56,856

- Oklahoma $57,180

- Utah $57,907

Median monthly memory care costs (SeniorLiving.org)

Total points: 25

Top 5 highest:

- Hawaii $11,000

- Vermont $10,941

- Maine $9,498

- Massachusetts $9,298

- New Jersey $8,877

Top 5 lowest:

- Wyoming $4,025

- Georgia $4,914

- South Carolina $4,990

- Utah $5,225

- Mississippi $5,295

Hourly private pay home care rates (APlaceForMom.com)

Total points: 75

Top 5 highest:

- Minnesota $43.00

- Vermont $42.00

- Oregon $41.00

- Hawaii $40.00

- Maine $40.00

Top 5 lowest:

- Mississippi $24.00

- Louisiana $25.00

- Alabama $26.00

- Texas $29.00

- West Virginia $29.00

Annual healthcare expenditures per capita (USAFacts.org)

Total points: 25

Top 5 highest:

- New York $14,007

- Alaska $13,642

- Massachusetts $13,319

- Delaware $12,899

- West Virginia $12,769

Top 5 lowest:

- Utah $7,522

- Idaho $8,148

- Nevada $8,348

- Texas $8,406

- Colorado $8,583

Annual Supplementary Security Income for aged people per capita in thousands of dollars (Social Security Administration)

Total points: -25 deduction

Top 5 highest:

- California $7.69

- Minnesota $6.94

- Washington $6.62

- Florida $6.45

- Massachusetts $6.42

Top 5 lowest:

- Mississippi $3.77

- Wyoming $3.86

- Arkansas $3.89

- South Carolina $4.24

- Alabama $4.25

Cost of living ranking (U.S. News & World Report)

Total points: 50

Each state received points equal to its cost-of-living ranking.

Top 5 highest:

- California 50

- New Jersey 49

- Hawaii 48

- Washington 47

- Massachusetts 46

Top 5 lowest:

- Arkansas 1

- Mississippi 2

- South Dakota 3

- Oklahoma 4

- Louisiana 5

| State | Minimum savings | Tax friendliness | Tax burden | Annual assisted living cost | Monthly memory care costs | Hourly private pay home care rates | Healthcare expenditures per capita | Supplemental Security Income per capita (thousands) | Cost of living | Totals |

|---|---|---|---|---|---|---|---|---|---|---|

| Hawaii | $2,212,084 | 25 | 11.48% | $139,807 | $11,000 | $40 | $10,291 | $6.11 | 48 | 387.99 |

| California | $1,612,716 | 50 | 9.27% | $90,846 | $6,500 | $38 | $10,299 | $7.69 | 50 | 333.82 |

| Massachusetts | $1,645,764 | 25 | 8.76% | $111,957 | $9,298 | $37 | $13,319 | $6.42 | 46 | 329.69 |

| Vermont | $1,153,051 | 50 | 10.73% | $97,304 | $10,941 | $42 | $12,756 | $5.30 | 26 | 327.67 |

| Maine | $1,144,038 | 50 | 10.57% | $98,726 | $9,498 | $40 | $12,077 | $4.45 | 29 | 325.14 |

| Connecticut | $1,116,998 | 50 | 9.99% | $110,684 | $8,312 | $33 | $12,489 | $5.70 | 41 | 321.76 |

| Rhode Island | $1,127,514 | 50 | 9.84% | $86,984 | $7,162 | $38 | $11,694 | $5.50 | 38 | 311.23 |

| New Jersey | $1,163,566 | 25 | 9.88% | $105,647 | $8,877 | $35 | $11,868 | $5.98 | 49 | 306.46 |

| New York | $1,292,753 | 25 | 12.28% | $77,868 | $7,765 | $35 | $14,007 | $5.90 | 45 | 304.72 |

| Minnesota | $870,642 | 50 | 10.19% | $71,997 | $7,765 | $43 | $10,846 | $6.94 | 32 | 290.91 |

| Oregon | $1,091,462 | 25 | 8.34% | $90,383 | $8,190 | $41 | $10,071 | $5.75 | 43 | 289.18 |

| Alaska | $1,292,753 | 0 | 5.16% | $126,047 | $8,750 | $40 | $13,642 | $4.76 | 39 | 284.6 |

| Washington | $1,145,540 | 12 | 8.32% | $86,211 | $7,845 | $40 | $9,265 | $6.62 | 47 | 273.5 |

| Maryland | $924,720 | 25 | 9.34% | $87,540 | $7,537 | $33 | $10,839 | $6.11 | 42 | 267.95 |

| New Hampshire | $1,113,994 | 12 | 6.85% | $75,520 | $8,775 | $38 | $11,793 | $5.22 | 44 | 265.05 |

| Arizona | $1,133,522 | 25 | 8.25% | $78,739 | $6,000 | $35 | $8,756 | $5.55 | 36 | 260.33 |

| Delaware | $944,248 | 12 | 5.52% | $105,771 | $7,424 | $35 | $12,899 | $5.55 | 34 | 250.8 |

| Colorado | $981,803 | 12 | 8.40% | $72,637 | $7,149 | $40 | $8,583 | $5.77 | 37 | 249.13 |

| Nebraska | $833,087 | 50 | 9.10% | $63,258 | $7,306 | $34 | $10,514 | $5.39 | 12 | 247.8 |

| Wisconsin | $930,729 | 25 | 9.12% | $76,014 | $7,098 | $35 | $9,982 | $5.06 | 21 | 244.53 |

| Illinois | $873,646 | 12 | 9.62% | $72,133 | $7,200 | $34 | $10,190 | $5.88 | 33 | 237.08 |

| Virginia | $948,755 | 12 | 7.93% | $80,495 | $6,803 | $32 | $9,195 | $5.78 | 35 | 234.25 |

| North Carolina | $905,192 | 25 | 8.17% | $78,532 | $6,700 | $30 | $8,917 | $4.50 | 23 | 233.16 |

| Utah | $1,083,951 | 25 | 8.75% | $57,907 | $5,225 | $33 | $7,522 | $5.78 | 25 | 229.76 |

| Pennsylvania | $864,633 | 12 | 8.53% | $75,402 | $6,800 | $32 | $11,603 | $6.03 | 31 | 229.63 |

| Montana | $851,114 | 25 | 7.22% | $75,813 | $8,110 | $36 | $10,212 | $4.54 | 11 | 229.23 |

| Ohio | $864,633 | 25 | 9.34% | $67,980 | $6,393 | $32 | $10,478 | $5.72 | 18 | 227.01 |

| New Mexico | $834,590 | 25 | 8.74% | $76,169 | $6,200 | $32 | $8,902 | $4.69 | 13 | 222.71 |

| Indiana | $810,555 | 25 | 8.01% | $66,311 | $6,135 | $32 | $10,517 | $5.12 | 19 | 220.7 |

| Kansas | $741,455 | 25 | 8.83% | $73,542 | $7,100 | $34 | $9,408 | $5.26 | 9 | 218.04 |

| Nevada | $942,746 | 0 | 8.39% | $75,520 | $7,046 | $35 | $8,348 | $6.06 | 28 | 217.53 |

| Missouri | $776,005 | 25 | 7.90% | $63,654 | $6,446 | $32 | $9,921 | $5.08 | 17 | 215.06 |

| Iowa | $797,035 | 25 | 9.53% | $64,068 | $6,500 | $32 | $9,789 | $4.97 | 7 | 213.11 |

| Michigan | $825,577 | 12 | 8.27% | $74,654 | $5,913 | $31 | $9,897 | $6.04 | 24 | 212.56 |

| Texas | $830,083 | 12 | 8.20% | $64,890 | $6,063 | $29 | $8,406 | $5.03 | 30 | 210.73 |

| North Dakota | $822,572 | 25 | 8.06% | $65,941 | $6,333 | $33 | $11,301 | $5.75 | 6 | 209.79 |

| Florida | $977,296 | 0 | 6.82% | $65,802 | $5,495 | $30 | $9,865 | $6.45 | 40 | 208.69 |

| Idaho | $971,288 | 12 | 7.93% | $56,856 | $5,500 | $35 | $8,148 | $4.95 | 16 | 206.69 |

| South Carolina | $869,140 | 12 | 7.48% | $59,198 | $4,990 | $30 | $8,766 | $4.24 | 22 | 201.02 |

| Kentucky | $834,590 | 12 | 8.80% | $60,558 | $5,650 | $30 | $10,257 | $4.70 | 14 | 200.24 |

| West Virginia | $712,913 | 12 | 9.06% | $69,216 | $6,200 | $29 | $12,769 | $4.43 | 8 | 199.3 |

| Tennessee | $791,027 | 12 | 6.18% | $66,219 | $5,339 | $30 | $9,336 | $4.56 | 20 | 194.75 |

| Wyoming | $872,144 | 0 | 6.47% | $58,092 | $4,025 | $37 | $10,989 | $3.86 | 15 | 192.67 |

| Georgia | $813,559 | 0 | 7.98% | $61,058 | $4,914 | $30 | $8,758 | $4.86 | 27 | 192.35 |

| Louisiana | $843,603 | 12 | 9.15% | $63,036 | $5,499 | $25 | $10,515 | $4.51 | 5 | 186.42 |

| Arkansas | $776,005 | 12 | 8.98% | $58,389 | $5,650 | $30 | $9,338 | $3.89 | 1 | 185.14 |

| South Dakota | $825,577 | 0 | 7.86% | $64,272 | $7,174 | $30 | $12,495 | $5.37 | 3 | 180.26 |

| Oklahoma | $759,481 | 12 | 6.94% | $57,180 | $6,349 | $30 | $9,444 | $4.36 | 4 | 178.71 |

| Alabama | $773,000 | 12 | 7.36% | $56,616 | $5,310 | $26 | $9,280 | $4.25 | 10 | 177.45 |

| Mississippi | $753,472 | 0 | 9.06% | $54,943 | $5,295 | $24 | $9,394 | $3.77 | 2 | 160.82 |

Sources

Kiplinger https://www.kiplinger.com/retirement/social-security/minimum-savings-to-retire-by-state

SmartAsset https://smartasset.com/retirement/retirement-taxes#washington/mostTaxFriendlyPlacesForRetirees-2

SeniorLiving.org https://www.seniorliving.org/assisted-living/costs/

SeniorLiving.org https://www.seniorliving.org/memory-care/costs/

SeniorLiving.org https://www.seniorliving.org/finance/state-taxes-seniors/

APlaceForMom.com https://www.aplaceformom.com/caregiver-resources/articles/in-home-care-costs

USAFacts.org https://usafacts.org/articles/which-states-spend-the-most-on-healthcare

Social Security Administration https://www.ssa.gov/policy/docs/statcomps/supplement/2024/7b.html

U.S. News & World Report https://www.usnews.com/news/best-states/rankings/opportunity/affordability/cost-living